Who we are

The M&A process is a unique moment in the lives of business owners which demands for a financial advisor able to maximize value.

The M&A process is a unique moment in the lives of business owners which demands for a financial advisor able to maximize value.

We have the technical skills to think of feasible ways to make transactions happen. Furthermore, we have the skills to understand the background and goals of business owners to protect and maximize the value of their assets.

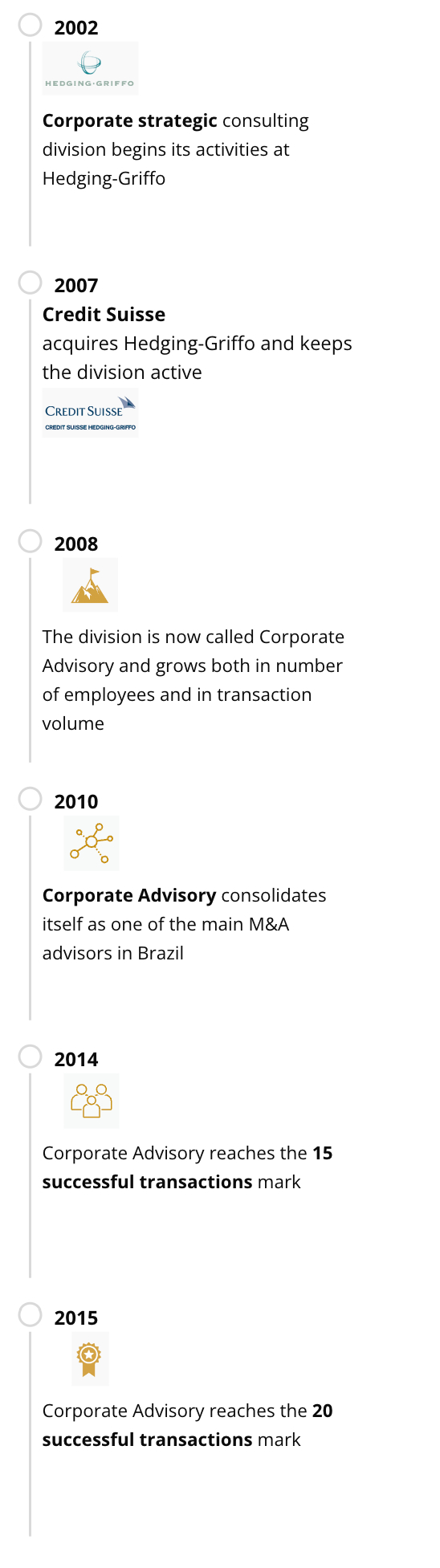

We are the continuity of the middle-market M&A department from Credit Suisse.

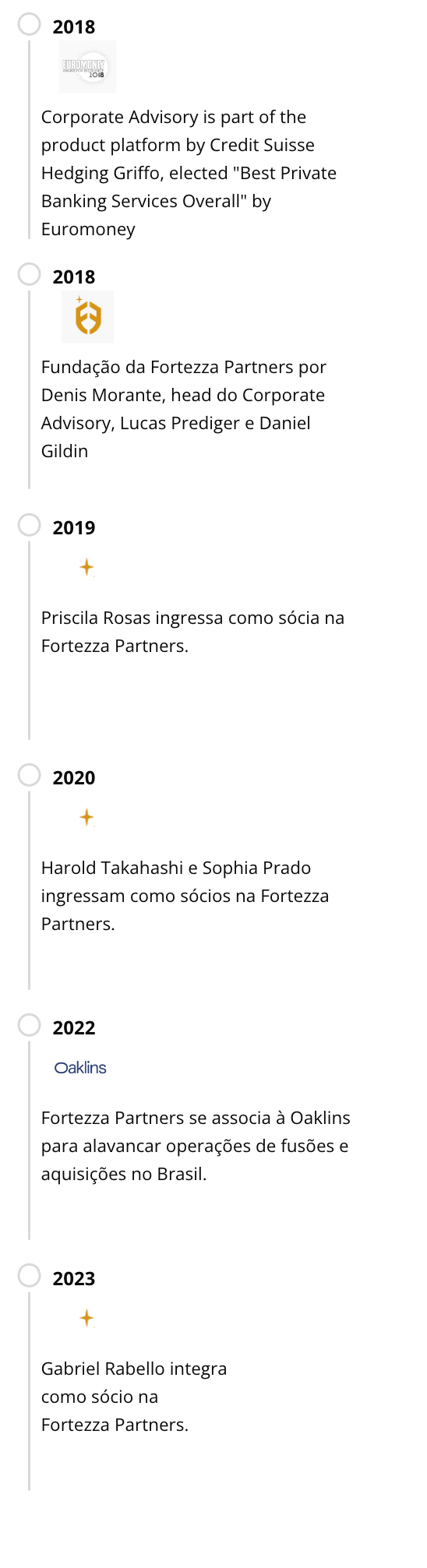

In 2021, we partnered with Oaklins to leverage merger and acquisition operations in Brazil. Meet this association.

Experience

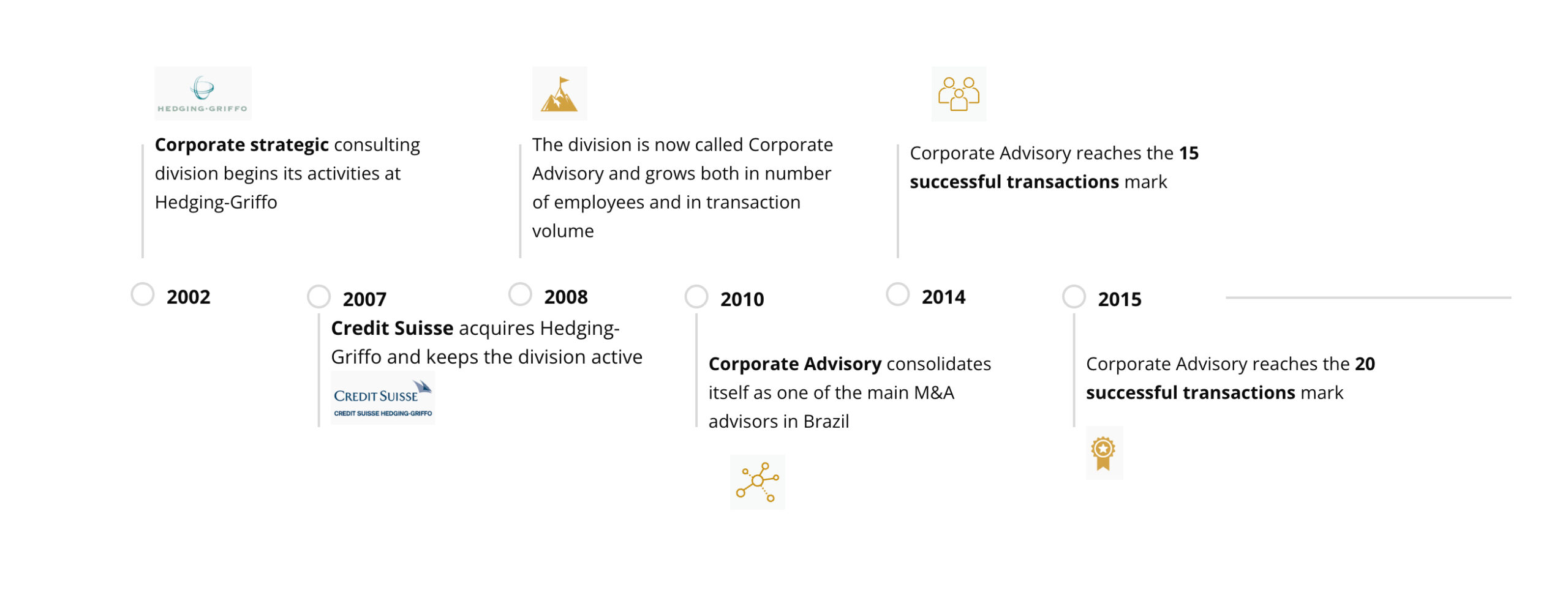

Fortezza’s Timeline